As a fleet manager, you know that every dollar counts. Fleet management costs can make or break your operation’s profitability, which is why mastering cost analysis is crucial.

Whether you’re managing a small fleet of five vehicles or overseeing hundreds of assets, understanding your fleet costs and managing them efficiently is the foundation of efficient operations.

A thorough fleet management cost analysis isn’t just about tracking fuel expenses—it’s about gaining a crystal-clear picture of every dollar spent on each vehicle in your fleet. More importantly, it helps you spot the ways in which costs unexpectedly add up.

For instance, our recent survey of fleet operators revealed that nearly a quarter of them experienced fuel fraud at least on a monthly basis, with almost a fifth reporting it at least weekly. Even more concerning, 62% of respondents noted they weren’t able to recover any of the money lost to fraud.

Data-backed fleet cost analysis can put an end to this wasted spend before it compounds.

Whether you’re new to fleet management or looking to optimize your operations, this article will help you make informed decisions about your fleet’s financial health.

What are Fleet Management Costs?

Fleet management costs refer to all expenses associated with operating and maintaining your fleet. While some people assume fleet costs simply mean vehicle purchase prices, the reality is far more complex. Fleet costs touch every aspect of your operation, from the moment you acquire a vehicle till its eventual retirement.

Fuel expenses often represent the largest portion of your operating budget, followed by maintenance, driver compensation, and essential equipment. However, the full scope of fleet costs extends well beyond these basics.

Modern fleet operations also invest in advanced technologies to optimize their spending. GPS tracking systems and telematics solutions, while an upfront fleet management software cost, often pay for themselves by helping reduce fuel consumption, minimize vehicle wear and tear, and improve route efficiency.

Administrative expenses form another crucial layer of fleet costs. These include essential obligations like vehicle insurance premiums, registration fees, and taxes. While these costs might seem secondary, they significantly impact your cost per vehicle.

The best way of organizing and tracking these expenses is to organize them into a few simple categories.

Types of Fleet Management Costs

Understanding how to categorize fleet management costs is crucial for effective financial planning and control. The most practical approach is to separate expenses into fixed and variable costs.

Fixed Fleet Management Costs

- Monthly lease or loan payments for trucks and equipment

- Down payments and interest charges

- Vehicle insurance premiums

- Any permits and commercial vehicle licenses

- Fleet management software subscriptions

- Other technology subscriptions like smart fuel cards

Variable Fleet Management Costs

- Fuel consumption and surcharges

- Idle time expenses

- Vehicle Maintenance

- Routine maintenance and repairs

While the above costs are easy to spot, there is one hidden source of expenses every fleet finds challenging to eliminate.

Hidden Costs: When Fraud Drains Your Fleet Budget

Fleet management costs don’t just come from normal operations—fraud and theft significantly impact your bottom line. According to our research, 53% of fleet managers suspect or have evidence of fuel theft in their operations, yet 63% report they weren’t able to recover any of the money lost to fraud.

The most concerning aspect from our survey was that internal threats pose a bigger risk than external fraud, like card skimming or theft. Over 50% of fleet managers report that unauthorized spending by employees is where their organizations are most vulnerable to fuel fraud.

Making matters worse, 74% of fleets take weeks or even months to detect fraudulent activities, allowing losses to accumulate significantly.

The financial impact can be substantial. While most incidents involve smaller amounts that add up over time, extreme cases have seen single drivers getting away with up to $20,000 in unauthorized spending.

So while tracking vehicle performance is important, prioritizing and unearthing fraud in your fleet management cost analysis is crucial for protecting your bottom line.

What to Watch Out for in Fleet Cost Management Data

A detailed fleet management cost analysis will uncover problematic areas in your fleet’s financial picture. Calculating fleet TCO and CPM can seem intimidating, but following these five steps will help you zero in on an analysis that gives you the right information.

The question is, what do you do with that data? Here are five problematic signs to watch out for in your fleet cost analysis:

Decreasing Vehicle Performance

If your fleet cost analysis shows declining vehicle performance, start by examining your telematics data for patterns. Look for gradual drops in power or acceleration across specific routes or loads—these often indicate deeper issues that your maintenance team should investigate.

Compare performance metrics between similar vehicles in your fleet. If truck #347 is consuming more fuel than trucks #348 and #349 on the same routes, dive into its maintenance history and driver assignments. Your fleet management software will help you spot performance variations quickly.

Next, cross-reference driver behavior data.

Are performance issues following specific vehicles or specific drivers? Check acceleration patterns, braking habits, and idling times.

Sometimes what appears as a vehicle performance problem in your fleet costs actually points to driver training or route optimization opportunities.

Inefficient Fleet Maintenance

When drilling into your fleet maintenance costs, map service intervals against performance data. Are oil changes happening too late, for example? Look for vehicles that consistently miss maintenance windows, then check if their efficiency metrics are dropping faster than similar vehicles in your fleet.

Pull up your telematics alerts alongside maintenance records. According to our survey, 60% of fleets aren’t tracking insights in an automated way, and 40% still haven’t adopted fleet management software. This lack of technological oversight can mask broader issues.

A vehicle throwing frequent engine fault codes between scheduled services might signal an underlying issue your mechanics are missing.

Pay special attention to repair notes—recurring “minor” issues often predict major problems that will impact your fleet operating costs.

For instance, if a technician noted unusual engine noise three months ago, and now that vehicle’s fuel efficiency is dropping, you’ve spotted a connection that deserves immediate attention. These patterns in your fleet management data often reveal preventive maintenance opportunities before they become expensive repairs.

Miscellaneous Cost Creep

When your fleet management cost analysis shows rising miscellaneous expenses, break them down by route, driver, and vehicle. Look for patterns in small purchases—are certain drivers consistently logging more incidental costs? Are specific routes generating higher unexpected expenses?

This is particularly concerning given that unauthorized purchases at gas stations are among the most common types of fraud, yet only 25% of fleets monitor costs beyond basic fuel consumption per our survey.

Map these expenses against their categories and timing. A smart fleet fuel card paired with fleet management software will help you spot trends like higher food expenses with certain drivers.

Pay special attention to costs that consistently fall just under approval thresholds—this could indicate spending pattern issues that need addressing.

Smart fuel cards bring these costs under control by automatically categorizing expenses and enforcing pre-approval policies. But first, dig into your historical data.

If food expenses have crept up 15% on your longer routes while local routes remain stable, you might need to revisit your per diem policies or route planning.

Higher Fuel Expenses

When reviewing your fleet management costs, don’t automatically blame rising fuel prices for increased spending. Dig into your telematics data to spot fuel consumption patterns.

Are some vehicles using more fuel on familiar routes? Check (in your fleet software) if drivers are deviating from planned routes or making unnecessary stops that drain your fuel budget.

Cross-reference your smart fuel card data with route efficiency metrics. Check for fill-ups at expensive stations or unusual purchase times.

Your fleet management software can reveal if drivers are missing opportunities to fuel up at preferred vendors or if route modifications have unknowingly increased fuel consumption.

Combine smart fuel cards with geofencing to tighten control. By restricting fill-ups to approved locations along optimized routes, you make your fuel costs more predictable.

When your data shows a driver attempting purchases outside these zones, it’s often a sign that route planning needs adjustment or driver training needs reinforcement.

Watch for unusual fuel grade usage— our survey shows a significant number of drivers using premium fuel against company policy, adding unnecessary costs to your fleet operations.

Here’s a concrete example using data in our survey. Our respondents are currently spending an average of $15,000 monthly on fuel.

Breaking this down:

- At current average prices, this represents about 4,210 gallons of fuel monthly ($3.56/gallon)

- Let’s assume a 70¢ premium between regular and premium gas

- If drivers use premium instead of regular, that’s an additional $2,950 in extra costs monthly (4,210 × $0.70)

- This adds up to around $35,400 in wasted spend annually

For a fleet of this size, proper fuel grade control through timely data review alone could save nearly $35,400 annually.

Fines and Toll Spikes

Watch for any uptick in traffic violations or toll charges. Map these incidents across your drivers and routes—are certain team members consistently acquiring fines? This pattern often reveals gaps in driver training or routing efficiency that directly impact your fleet operating costs.

Look closely at your toll expenses by route. If specific runs are racking up higher charges, your routing might need optimization.

Cross-reference this data with delivery times—are drivers taking toll roads to make up for poor schedule planning? Compare the costs of tolls against the time saved to identify whether these decisions make financial sense.

Check if violations cluster around certain times or locations. Your fleet management software should help you spot patterns like speeding tickets during tight delivery windows or parking violations in specific urban areas.

These insights often point to needed adjustments in scheduling or route planning that can prevent future costs.

Take Control of Your Fleet Costs Today

Managing fleet costs well starts with understanding your data and knowing what patterns to watch for. By monitoring vehicle performance, maintenance trends, miscellaneous expenses, fuel consumption, and compliance costs, you can spot potential issues before they significantly impact your bottom line.

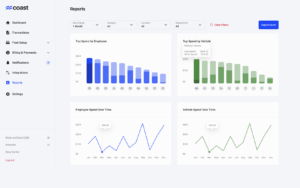

Your fleet management software and telematics systems are only as valuable as your ability to interpret their data and take action. Add a smart fuel card like Coast to the mix, and you can lean on technology to automate busywork and focus on deeper cost analysis.

Check out how Coast’s open-loop smart Visa fuel cards prevent misuse and boost fleet ROI.