Managing a fleet means keeping track of fuel, maintenance, and day-to-day expenses, and a fleet card is one of the simplest ways to do that.

The challenge is that there are many fleet cards on the market, and they all offer something different. Some are built for car and van fleets, others are designed for heavy-duty trucks, and some cards now support electric vehicles as well. They also offer different savings, from fuel rebates to cash-back programs, which can make it hard to know which option best fits your fleet’s needs. Some also focus on the card itself, while others include tools like controls, reporting, or integrations with fleet tools.

To make the decision easier, we’ve narrowed the list down to the 14 best fleet credit cards available today. In this article, we explain:

- what each card offers

- where it can be used

- its pros and cons

All so you can make the right choice.

How We Chose the Best Fleet Credit Cards

We selected the best fleet credit cards by looking at the features that matter most to real-world fleet operations, including:

1. Strong, flexible spending controls

Good controls help prevent overspending and misuse. We chose cards that let managers set limits by driver or vehicle, restrict merchant categories, adjust allowed hours, and track purchases in real-time.

2. Clear fuel savings and cost benefits

We compared discount networks, rebate structures, and cash-back programs to understand how each card helps lower fuel costs. We also examined fee structures to ensure that the savings outweigh the costs.

3. Reporting tools and integrations

Managing a fleet requires clean, reliable data. So, we favored cards with strong reporting features and integrations with telematics and accounting platforms. These tools help fleets track usage, simplify IFTA reporting, and cut down on manual admin work.

4. Ability to handle more than fuel

Fleets spend money on much more than gas. We prioritized cards that can cover maintenance, parts, tolls, parking, car washes, and other on-the-road expenses. Cards that support broader spending help fleets avoid juggling multiple payment systems.

The 14 Best Fleet Credit Cards

1. Coast

The Coast fleet card is a Visa-based charge card that helps local commercial fleets manage fuel and day-to-day operational expenses. Unlike traditional fleet cards that work only at specific stations, Coast works at locations that accept Visa, which gives drivers more flexibility on the road.

Drivers can use Coast cards for fuel, maintenance, parts, tolls, car washes, parking, hotels, and other fleet-related purchases. Coast offers fuel rebates of 3¢–9¢ per gallon at its network of over 30,000 partner stations, along with 1% cash back at merchants other than gas stations..

Coast provides granular controls to help prevent misuse of funds. Managers can set spending limits for each driver or vehicle, restrict merchant categories (e.g., fuel only), and specify the days and times drivers can use their cards.

When a driver uses their card, the Coast platform captures line-item data, including fuel type, price per gallon, and purchase amount, and then links the transaction to a specific driver and vehicle. This gives managers a clear view of fuel usage, spending trends, and potential inefficiencies.

Coast integrates with telematics systems like Samsara and Geotab, which can help managers block suspicious transactions and flag anomalies in real-time by comparing card activity with GPS data, fuel tank size, odometer readings, and other signals. It also connects to accounting tools like QuickBooks to automate coding, reconciliation, and IFTA (International Fuel Tax Agreement) reporting.

To show its commitment to security, Coast offers a $25,000 annual fuel fraud guarantee that covers both external and employee fraud (Terms apply).

- 3-9¢ at 30,000+ stations, plus rebates on every gallon on your statement

- Use anywhere Visa is accepted for maximum flexibility

- Advanced spend controls and real-time reporting

- Advanced telematics, fleet management, and accounting integrations

- Extra security with mobile card unlock, with no risk of PIN sharing or theft

- Option to use as a corporate card with built-in controls at no additional cost

- Easy-to-use portal and responsive support

- May not deliver full value for trucking-focused businesses

- Less suited for very small fleets (fewer than five vehicles)

- No prepaid card option available

2. WEX Fleet Card

WEX Fleet Card is a closed-loop fuel solution specifically designed to help businesses control and manage fuel and vehicle maintenance expenses. This fleet card provider offers over 50 card options for various types of fleets, including large fleets and government fleets.

WEX provides fleet managers with spending controls, which enable them to restrict purchases by product type (e.g., fuel-only), time of day, driver ID, and odometer reading.

WEX also collects detailed transaction data at the pump, which removes the need for manual receipts and helps companies calculate miles per gallon (MPG), simplify IFTA (International Fuel Tax Agreement) reporting, and build accurate performance reports.

The platform integrates with major accounting and fleet tool.

- Accepted at 95% of gas stations

- Advanced spend controls

- Customizable report options

- Your local station might not accept the card

- Some cards have rebates that expire after a few months

- Rebates are broken into tiers and the amount you save is dependent on how much fuel you purchase in a given month

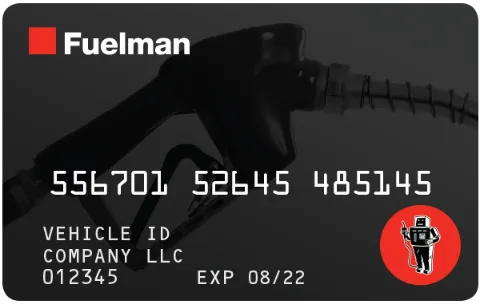

3. Fuelman Card

Fuelman is a fleet credit card program that helps businesses manage fuel and vehicle-related spending through a mix of controls, reporting, and network partnerships. Each account comes with a monthly fee that covers all cards.

Fuelman has a Discount Network, which includes more than 40,000 fueling locations in the United States. Drivers who fuel within this network can access per-gallon rebates.

The platform also allows managers to set limits based on driver, vehicle, day, or spending category. Higher-tier Fuelman plans also include access to a maintenance network.

- Real-time fraud alerts

- Discount network

- Fuel controls

- Some options like customizable dashboards, maintenance, or fraud guarantee are only available on more expensive plans

- Invoices must be paid in full and on time in order to receive rebates

- Extended network fee of $3 for stations outside of their network

4. EFS

The EFS Fleet Card is a payment and fleet management system designed for mid-to-large trucking fleets that need tight controls, detailed reporting, and support for high-volume diesel usage. As part of the WEX family, it focuses on over-the-road (OTR) operations and gives carriers tools to manage fuel and non-fuel spending across long routes.

EFS allows managers to set real-time limits for each card and control spending by driver, vehicle, category, or location. Drivers typically enter a PIN at the pump, which can help track exactly who is making each purchase and where it takes place.

Through the WEX CardControl and EFS CarrierControl apps, drivers and managers can view balances, move funds, find fueling locations, and manage card settings from the road. Beyond fuel, drivers can use the card to pay for repairs, permits, cash advances, and settlements, which helps consolidate spending on one platform.

- Valuable features for trucking businesses, such as cash advances and ATM withdrawal

- Mastercard product can be used for fuel and fleet expenses where Mastercard is accepted

- Spend controls

- Limited network of 12,000+ gas stations, if not using the Mastercard product

- Applies transaction fees to merchants out-of-network for EDGE card

- Might not be as valuable for non-trucking businesses

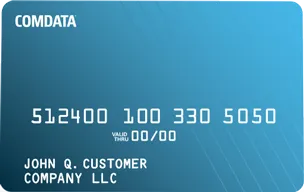

5. Comdata

The Comdata Fleet Card is a closed-loop payment system built for small fleets, large OTR carriers, and companies that operate electric vehicles (EVs).

Comdata is accepted at 8,000+ truck stops across North America, including TA/Petro, Pilot Flying J, and Love’s. Drivers can use the FleetAdvance mobile app to see their exact contracted fuel price before they arrive.

Comdata supports electric vehicles through ChargePass, a solution that covers both EV charging and traditional fueling. ChargePass also supports payment options like mobile payments, Apple Pay, RFID, dip, and tap-to-pay.

Comdata offers financial tools like Comchek® to help drivers make electronic money transfers and Lumper Pay with eReceipts, so they can electronically capture transaction documentation. Managers can track spending and route patterns through the OneLook analytics platform.

- Accepted at 95% of gas stations

- Advanced spend controls

- Customizable report options

- If you don't have a trucking business, you might not see the full value of the card

- Limited network of 8,000+ gas stations, when not using the Mastercard product

6. AtoB

AtoB is a fleet payment platform built for local fleets, mixed-fuel fleets, and electric vehicles. It offers four types of cards that support different needs:

– The AtoB Fleet Card, which helps drivers to pay for fuel, tolls, lumpers, weigh stations, towing, lodging, and other on-the-road expenses.

– The Business Expense Card, which gives fleet owners and managers a way to pay for tires, parts, services, permits, rent, and insurance.

– The Driver Payroll Card, which allows companies to pay drivers instantly and create reward programs that encourage smart fueling choices.

– The AtoB Unlimited Fuel Card, which is a Visa-based prepaid card that helps businesses build credit on every purchase.

Because AtoB uses Mastercard and Visa, the cards are accepted almost everywhere. Managers can set detailed controls that limit spending by time of day, merchant, product category, and location. They can also issue or disable cards and whitelist/blacklist merchants.

- Accepted at more than 30,000 fuel stations and over 200 truck stops

- Strong fraud protection, including a $250,000 fraud protection guarantee

- Offers a credit card that reports to Experian, which may help build business credit (AtoB Flex Card), and a prepaid card that requires no credit check or personal guarantee (AtoB Unlimited Card)

- Some advanced tools, such as the full FuelMap and stronger security controls, require a premium upgrade

- To unlock the maximum per-gallon discounts, drivers must use the mobile app to find discounted stations

7. Motive Fleet Card

The Motive Fleet Card is a payment system that combines fleet management with spend control. It runs on the Mastercard network, so fleets can use it anywhere Mastercard is accepted to pay for fuel, repairs, lodging, parts, and more.

Motive offers customizable controls, which managers can use to:

– Set spending limits by day, time, amount, and location

– Help block certain merchants and spend types

– Adjust spend categories in real-time

Motive links vehicle telematics data (GPS, odometer, fuel level) with vehicle data. This integration powers a fraud system that can help decline suspicious purchases. In terms of savings, Motive offers rebates at more than 35,000 partner locations.

- Tier-1 discounts on diesel at truck stops

- Integration between Motive's telematics and fuel card

- Spend controls

- Most rebates are on diesel, so you might not realize the full value if you operate gas vehicles

- Fuel fraud guarantee doesn't cover fraud by employees

8. Shell Cards

Shell Card is a payment solution that lets drivers use one physical or virtual card for fuel, EV charging, and in-store purchases at Shell locations.

Shell has a large global footprint, with acceptance at more than 150,000 fueling sites and over 1 million EV charging points across 75 countries. In the United States, however, Shell offers two fleet products:

– Shell Card Business, a basic option that provides savings of up to 6¢ per gallon at 12,000+ Shell stations.

– Shell Card Business Flex, a more versatile option that is accepted at 95% of U.S. fuel stations.

Shell Cards can help reduce fraud through email alerts for unusual activity and chip-and-PIN protection for lost, stolen, or counterfeit cards.

- Attractive rebates at Shell stations

- Option to choose between a Shell only card, and a card with 95% coverage

- Supports EV charging

- Rebates based on the number of gallons purchased. Small fleets might have trouble getting the full value.

- Shell Card Business can only be used at Shell stations

9. ExxonMobil Fleet Cards

ExxonMobil offers two fleet card options that help businesses manage fuel spending while earning rebates at Exxon and Mobil stations.

– The ExxonMobil FleetPro card is built for mixed fleets and heavy-duty diesel operations. It works at 12,000+ Exxon and Mobil locations and over 800 commercial diesel pumps, where fleets get customized pricing and discounts.

– The ExxonMobil BusinessPro card (private label and universal) is powered by WEX and is designed for light-duty fleets such as cars and vans. It’s accepted at 95% of fuel stations across the United States, including all Exxon and Mobil stations.

Because ExxonMobil fleet cards carry Mastercard acceptance, fleets can use them for non-fuel purchases such as maintenance, parts, travel, and service work.

ExxonMobil also provides online and mobile tools that managers can use to view card activity, access invoices, download reports, and update cardholder details. They can also set limits by product type, time of day, dollar amount, or merchant.

Managers can maintain control over the purchases drivers make by requiring them to enter PINs or odometer readings before each purchase.

- Attractive rebates at Exxon and Mobil stations

- Spend controls and reporting

- Exxon only card has no setup, card or annual fees

- Unless you select their universal program, the card only be used at Exxon and Mobil stations

- If you want to get acceptance outside Exxon stations, you will need to upgrade to their Universal card, which has card fees

- Reliance on driver PINs leaves cards susceptible to fraud

10. Voyager Fleet Card

The Voyager Fleet Card, issued through U.S. Bank, works at more than 320,000 fueling locations, over 60,000 maintenance and repair shops, and more than 10,000 independent truck stops.

Instead of selling directly to fleets, U.S. Bank partners with third-party providers such as Edenred, Fuel Express, and CNRG Fleet, who each offer their own pricing structure, rebates, and customer support.

Voyager allows managers to set rules by product type, dollar limit, time of day, or number of transactions. Drivers are typically required to enter a PIN and often an odometer reading before each purchase. As soon as the transaction is complete, managers can receive an alert with all purchase details.

- Option between a Mastercard to maximize acceptance and a Voyager-only card for fleets needing access to private fueling sites and truck stops

- Spend controls and reporting

- Mastercard product is also accepted in Canada and Mexico

- If you choose the Voyager+ card, network of stations might be limited

- Mastercard product doesn't advertise any rebates

11. Chevron/Texaco Business Card

The Chevron/Texaco Business Card, issued by WEX, offers three card options that help fleets manage fuel spending, improve security, and simplify administration, including:

– The standard Business Card has no setup, annual, or card fees, but it is limited to only 8,000+ Chevron and Texaco stations. This option works well for fleets that already fuel regularly in those stations.

– The Business Access and Business Access Flex cards are more flexible. WEX states the Business Access and Business Access Flex cards are accepted at up to 95% of U.S. fuel stations and 45,000+ service locations through the WEX network. However, drivers get higher savings rates when they fuel at Chevron or Texaco stations.

Each card includes detailed spending controls through which managers can set limits by product type, daily amount, number of transactions, or time of day.

Drivers enter their ID and often an odometer reading at each purchase.

- Rebates at Chevron and Texaco stations

- Flexibility to choose between a Chevon/Texaco only card, and a card with 95% coverage

- Spend controls and reporting

- Rebates based on the number of gallons purchased. Small fleets might have trouble getting the full value.

- Chevron Business Card can only be used at Chevron and Texaco stations.

- Business Access Card charges $2/transaction fee when used outside of Chevron and Texaco stations

12. Circle K Pro Fleet Cards

About

The Circle K Pro Fleet Card is a fleet card program that helps businesses save on fuel and manage their fleet expenses. It’s accepted at more than 6,000 Circle K locations.

Circle K offers two main physical cards:

– Pro Fleet Card: This card has no monthly or annual fees and works only at Circle K locations. Drivers can use it for fuel and car washes, making it a simple, cost-effective option for fleets that stay within the Circle K network.

– Pro Universal Card: This card is accepted at 95% of U.S. fuel stations through the WEX network and offers the best savings at Circle K. It supports fuel, car washes, and WEX-accepted services, including maintenance, repairs, and roadside assistance.

Since both cards run on the WEX security platform, they require Driver ID and odometer readings for every transaction. This can help prevent misuse and keep records accurate for reporting.

The program allows fleet managers to set purchase limits and track transactions through a dedicated online portal.

Circle K also offers a mobile app called Digital+, which allows drivers to pay with a virtual card at any station that accepts Visa.

- Zero card fees for Circle K Pro Fleet Card

- Save at least 10¢ on every gallon at Circle K stations

- Spend controls by transaction, vehicle, and driver

- Circle K Pro Fleet Card can only be used at Circle K stations

- Need to upgrade to Circle K Universal Card in order to get broader card acceptance

- Rebates are only available at Circle K stations

Considerations When Picking A Fleet Credit Card

Now that you’ve seen what each card offers, you can narrow the options and make a choice by considering the following factors:

1. Expense management

A strong fleet card should simplify your back-office work. So, look for cards that automatically organize expenses, match transactions to specific drivers or vehicles, and generate clear reports for fuel, maintenance, tolls, and other operational costs. Good expense management reduces admin time and gives you a clearer view of where your money goes.

2. Merchant networks and acceptance

If your drivers travel across multiple regions, a card with broad acceptance can prevent detours. Some cards work at 95% of U.S. stations through networks like WEX, while others, like Coast, work at locations that accept Visa. Using a card with a broad acceptance network helps keep schedules consistent because your drivers don’t have to change routes to find fuel stations or repair shops.

3. Rebates, discounts, and cash back

Savings can vary a lot between cards. If you want savings beyond fuel, a program that includes cash back on repairs, lodging, parts, or tolls can offer better long-term value.

4. Security features

Protecting your fleet (and funds) from misuse and fraud is essential. So, look for cards that monitor purchases, send alerts for unusual transactions, and can block suspicious activity in real-time. Some platforms compare purchases with telematics data to catch anomalies quickly.

Also, check how easy it is to lock or deactivate a card if it gets lost or stolen. Strong security tools can save your business from unnecessary losses.

5. Personal guarantees

Many fleet credit cards require a personal guarantee. This means the business owner is personally responsible for paying the balance if the company cannot. So, check if a fleet card requires a personal guarantee before signing up.

If you prefer to avoid a personal guarantee, check if the provider offers alternatives such as prepaid or cash-secured programs.

Why Pick Coast For Your Fleet Business Credit Card

Of all the fleet card options we covered, Coast stands out because it gives fleets the flexibility they need to operate without sacrificing control or visibility for managers.

Since Coast works anywhere that accepts Visa, drivers can more easily stay on route and avoid unnecessary detours. And managers get powerful controls that allow them to set limits by driver or vehicle, restrict merchant categories, specify days and times the card can be used, and monitor spending as transactions post.

Coast also delivers meaningful savings. You earn 3¢–9¢ per gallon at over 30,000 partner stations and 1% cash back on non-fuel fleet spending, which can help reduce the cost of everyday operational needs such as repairs, tolls, and parts.

The platform integrates with telematics and accounting tools to automate workflows, help block suspicious transactions, and simplify tasks like IFTA reporting.

If you’re looking for a fleet card that combines flexibility, savings, and easy fleet expense management, Coast is a strong choice.

Ready to get started? Apply now.

Fleet Credit Card FAQs

What is a fleet credit card?

A fleet credit card is a payment card that businesses give to their drivers to pay for fuel and other fleet-related expenses, like maintenance, repairs, car washes, parking, and tolls. Unlike standard credit cards, a fleet card offers detailed reporting, customizable spending controls to help prevent fraud, and often includes fuel discounts based on volume purchases.

How is a fleet business credit card different from a regular business credit card?

A regular business credit card is built for general company spending, while a fleet credit card is designed specifically for vehicles and drivers. Fleet cards offer controls based on drivers, vehicles, fuel types, and merchant categories. They also track fuel usage, capture odometer readings, and provide reports that support tax filings like IFTA. Regular business cards don’t offer this level of fleet-specific detail.

Who should use a fleet credit card?

Any business with multiple vehicles can benefit from a fleet card. This includes delivery services, construction companies, HVAC and plumbing businesses, landscaping companies, transportation services, and other operations with drivers on the road every day. Fleet cards help these businesses control spending, streamline reporting, and reduce administrative work.

Where can a fleet credit card be used?

This depends on the type of card. Some fleet cards, like Chevron/Texaco’s standard Business Card, are accepted only at branded locations within a closed network. Others operate on networks like WEX, which cover about 95% of U.S. stations.

Open-loop cards, such as those on the Visa or Mastercard networks, can be used at locations that accept those payment brands. Always check the acceptance network before choosing a card.

What’s the difference between an open-loop and a closed-loop fleet credit card?

A closed-loop fleet card can be used only at specific stations or inside a specific fuel network. These cards often provide high rebates/discounts, but limit where drivers can fill up.

An open-loop fleet card, on the other hand, runs on a major payment network like Visa or Mastercard, so it can be used at a wider range of locations. These cards offer more flexibility and can usually cover fuel, maintenance, tolls, parking, and other business expenses.